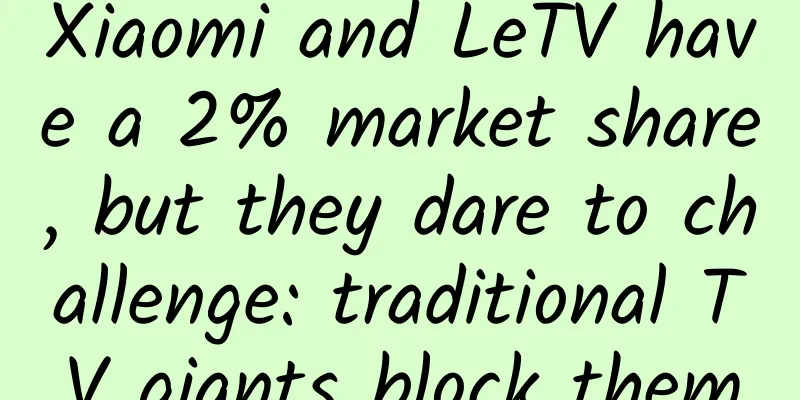

Xiaomi and LeTV have a 2% market share, but they dare to challenge: traditional TV giants block them

|

The bustling world of the Internet seems to have long forgotten the traditional manufacturing industry. Even in the television industry where Internet giants are forcing their way into the market, the voices of traditional television giants are rarely heard in the market. In 2009, Jia Yueting established the LeTV TV division and officially entered the TV industry, stirring up a storm. LeTV TV, like Xiaomi mobile phones back then, quickly gained a place with the same high cost-performance and online sales strategy. Recently, LeTV announced that since the launch of Super TV X60 on July 3 last year, the sales of Super TV have reached nearly 1 million units a year. LeTV TV, with its brand-new concept and profit model, has overturned the single profit model of traditional TV manufacturers that relies solely on hardware, and has had a great impact on the ideology of traditional home appliance manufacturers. Although the sales volume of both parties is still insignificant, LeTV TV is still insignificant. A thousand-mile dam is destroyed by an ant hole. After consumer demand gradually shifts from passive TV viewing to active TV viewing, the transformation of traditional TV manufacturers is imperative. Xiaomi TV sales in the first half of the year were less than 100,000 units Yi Xiaoyi, an analyst at Bohai Securities, believes that there are many profit models for smart TVs, but they are still in the exploratory stage. There are three main profit models: the first is the profit model of selling hardware for traditional color TVs, which mainly relies on hardware while taking into account content; the second is the profit model of "content + service" for Internet companies such as LeTV and Xiaomi. The third model is the cooperation model of MTC, Wasu Media, Alibaba and Haier, which implements cooperation through specific methods including but not limited to "prepaying service fees to get a smart cloud TV". For decades, the Chinese television industry has relied on hardware sales as its main profit model. Until the emergence of LeTV TV, which was like the "Xiaomi" in the mobile phone industry, it completely broke this traditional profit model. In the past year, LeTV TV has relied on the LeTV ecosystem of "platform + content + terminal + application" and, through the quadruple revenue model of "hardware revenue + content revenue + advertising revenue + application sharing", insisted on high cost-effectiveness of twice the performance and half the price, breaking through the industry's price bottom line and gaining recognition from a group of users. It can be said that LeTV Super TV has redefined television in an unprecedented way. Recently, Peng Gang, senior vice president of LeTV TV, said that Super TV is not just a TV, but a complete large-screen Internet ecosystem. With the support of tens of millions of fans and through vertical integration of the industrial chain, the fusion effect of LeTV's ecosystem is continuing to emerge. Unlike traditional TV manufacturers who sell through offline channels, LeTV TV uses a "de-channelization" approach to sell super TVs. That is, it sells LeTV TVs through its own e-commerce platform. However, due to its own limitations, its production, logistics, after-sales and other links are outsourced to third-party service platforms. However, a single sales channel is likely to be a bottleneck in the development of LeTV TV. LeTV is also seeking more channels, such as joining forces with Gome to promote LeTV TV through Gome's online and offline channels. The originator of this model can be said to be Xiaomi mobile phone. Xiaomi, which has tasted the sweetness of mobile phones, is not far behind and officially launched Xiaomi TV in 2013. According to an insider, the sales volume of Xiaomi TV in the first half of this year was less than 100,000 units. "I think the sales volume of Xiaomi's TV is still very small so far. Unlike LeTV, LeTV has LeTV Pictures, LeTV.com and others that provide upstream copyright content, so LeTV can have a certain cost dilution effect on software and content services when making TVs. But Xiaomi has no advantages in making TVs. Xiaomi has no technical accumulation, no factories, no (offline) sales channels, and more importantly, in the era of Internet TV, Xiaomi does not have any film and television copyright resources. So I think Xiaomi's TV business should have a similar ending to that of Quanta Computer, Lenovo, Tsinghua Tongfang and others, and it will be difficult to make any progress." Liang Zhenpeng, an industrial economist observer, told the reporter of Money-week (public account: Money-week). In Liang Zhenpeng's opinion, although LeTV TV's sales volume is far lower than that of traditional TV giants, compared with Quanta Computer, Tsinghua Tongfang and Lenovo, which have been making TVs for many years but are still failing, LeTV TV still occupies a place. Traditional TV giants are forced to transform LeTV TV seems to have triggered a "catfish effect" in the TV market, which has aroused the vigilance of traditional TV manufacturers and they have begun to seek transformation. "Although LeTV's sales volume is very small in the entire TV industry, the new concept it brings is worth learning for traditional companies, such as trying to attract consumers in its own content and software. Providing games, payment, shopping functions, etc. are all explorations." Liang Zhenpeng told the reporter of Financial Weekly. Internet companies have always been good at hype. LeTV TV and Xiaomi TV continue to attract market attention, but in fact, in terms of market share, low-key and pragmatic traditional TV manufacturers still firmly occupy the market. Data from the third-party home appliance market monitoring agency Zhongyikang shows that in 2013, about 50% of the TV market sales came from smart TVs, with an annual growth rate of 56.84%, which is much higher than the overall annual growth rate of 8.66% for color TVs. Domestic TV brands accounted for 60% of the market, with a retail volume of 64.66%. Among them, Hisense had the highest market share of 15.34%, Skyworth 13.76%, TCL 12.79%, Changhong 11.41% and Konka 11.36%. In 2013, the sales of LeTV and Xiaomi TV were 300,000 and 18,000 respectively. LeTV was launched in May 2013, and Xiaomi was launched in September 2013. In 2013, the sales of TV sets in China were about 50 million, and the sales of Internet-connected TV reached 26 million. Xiaomi and LeTV together accounted for less than 2%. Although their sales volumes are not at the same level, LeTV and Xiaomi have surpassed traditional TV companies in momentum. Traditional home appliance companies have also begun to transform and enter the Internet TV field. At present, there are two main transformations of traditional TV manufacturers: one is to switch from producing flat-panel TVs to producing smart TVs, such as Konka’s announcement in March this year that it would stop developing non-smart TVs; the other is the cross-border integration of traditional TV manufacturers and Internet video companies to create smart TVs with excellent software and hardware. The latter is the main focus. As a giant in traditional TV sets, Hisense's transformation also leads the entire traditional TV industry. In April 2013, Hisense took the lead in launching the Internet TV VIDAA TV. With its minimalist control experience and design, it subverted the traditional TV form and brought an impact to the then generally "similar" TV market. It is currently the smart TV with the highest activation rate. In just 8 months after its launch, it contributed more than 1 million units of sales to Hisense. In March this year, Hisense launched its Internet strategy and cooperated with 11 video websites including Future TV, iQiyi PPS, Phoenix Video, Ku6 , LeTV, Lekan, PPTV, Sohu Video , Tencent Video, Youku Tudou , and Youpeng to jointly create the video integration application "Ju Haokan". It is reported that "Ju Haokan" is an application that integrates a large amount of video content from 11 video manufacturers such as iQiyi and Sohu. After integration, users do not need to search one by one when looking for dramas, but can directly access the content of 11 applications with one click, and all content is genuine. However, the industry has also questioned Hisense's "tycoon" approach. It is difficult for major video content providers to fully reflect their focus on creating features and user experience. This cooperation model cannot fully reflect their respective advantages, but is more about participation. Moreover, it involves complex profit sharing, and Hisense may not be able to treat it equally. "Signing contracts with 11 video companies will not effectively improve Hisense's competitiveness at the moment, because these 11 companies are not exclusive collaborations, and other color TV manufacturers are also signing contracts," Liang Zhenpeng commented. Indeed, Changhong was not to be outdone. Since 2011, Changhong has established the "three coordinates" of intelligence, networking and collaboration, comprehensively built the home Internet, and released the cloud video ultra-clear machine S10/11 in the first quarter of 2011. Subsequently, Changhong also cooperated with Youku, Tudou and iQiyi to enter the smart TV field, and Youku and Tudou also took the opportunity to officially enter the smart TV field. TCL is a latecomer who has surpassed the competition. In 2013, it launched the "iQiyi Smart TV TV+" in cooperation with iQiyi. The TV integrates many video resources including iQiyi and PPS. Users can watch more than 200,000 episodes of high-definition video content on TV+ for free without paying any additional fees, covering movies, popular dramas, variety shows, animation and other fields. The launch of iQiyi smart TV has ignited the competition among BAT for the smart TV living room market. Just seven days after the launch of iQiyi smart TV, Alibaba announced that it would join hands with Skyworth to launch Coocaa smart TV. This TV is an Internet TV equipped with Skyworth's Tianci system and Alibaba Cloud OS. The 42-inch youth version is priced as low as 1,999 yuan, bringing the price of Internet TVs above 40 inches to less than 2,000 yuan. Different from other hardware + video content collaborations, Coocaa will be embedded in Alibaba's e-commerce platform, which actually leaves an entrance to a department store in people's homes. The TV screen becomes another shopping portal after PCs and mobile phones. Moreover, if the products used by celebrities in film and television programs are properly linked and recommended by e-commerce companies, the commercial value potential they contain is unlimited. LeTV and Xiaomi replace traditional TV vendors? Difficult! Change is imperative, but there are many contradictions in the specific implementation of cross-border cooperation. At present, the most successful cross-border cooperation is the smart TV launched by iQiyi and TCL. According to data from China Market Research, TCL & iQiyi sold 100,000 sets of smart TV in 2013. It is a leader among the smart TVs of several cross-border cooperations. However, less than a year into the cooperation, the two sides started to complain to each other. According to previous media reports, TCL's complaint to iQiyi was that the cost of the first product launch conference of the cooperation between the two parties was hundreds of thousands of yuan, all of which was borne by TCL, but the outside world interpreted it as iQiyi's smart TV, ignoring TCL; iQiyi only had the right to make suggestions but not the right to make decisions in terms of hardware specifications and pricing, and its role was very limited. Ultimately, the root cause of the conflict between the two sides lies in the different mindset of traditional enterprises and Internet enterprises. iQiyi hopes that TCL can lower the price and increase the popularity of smart TVs, and promote iQiyi's smart TV client for them. Only when the popularity reaches a certain level, iQiyi may share the advertising revenue with TCL, while TCL still hopes to make a profit from each smart TV sold. This involves the difference between the two business models. The business model of Internet TV is completely different from that of traditional TV manufacturers. Different from the profit model of traditional TV manufacturers based on hardware sales, sales volume is even more important for Internet TV, which is the basis for their profit model to take effect. Because the business model of Internet TV is no longer to make money from TV hardware alone, but to make money from content distribution, application distribution and advertising after accumulating a user base. Lei Jun once said that if the sales volume of Xiaomi TV is not large enough, it will suffer huge losses. As for how large, he did not disclose. Xiaomi mobile phone started to make money after 300,000 units were produced, and Xiaomi TV still has a long way to go. Therefore, in the current cooperation between traditional TV manufacturers and Internet companies, the former occupies a strong position. In addition, the most obvious contradiction is the cooperation between Changhong and Youku Tudou. Youku Tudou originally attached great importance to this cooperation and wanted to use this exclusive cooperation as an opportunity to enter the smart TV field. However, things did not go as planned. Youku Tudou's "over-enthusiasm" raised a lot of opinions on Changhong's hardware configuration, price, software optimization and other aspects, which was considered by Changhong as "meddling". The contradiction became increasingly intensified until the eve of the launch of the cooperative product, when Changhong suddenly pulled in iQiyi, causing the plan of exclusive cooperation with Youku Tudou to fail. Youku Tudou also did not attend the new product launch conference that day, and many unique functions created for Changhong smart TVs were temporarily cancelled. Of course, Youku Tudou is no pushover. Subsequently, Youku Tudou began to look for new partners, announcing cooperation with Haier and Konka to embed Youku's smart TV system into the products of these TV manufacturers, and also cooperated with ZTE 9city FunBox, Landing Technology's Goldweb box and Jiuzhou Group's Jiuzhou Jingling to embed Youku Tudou's video services into them. After unsuccessful cross-border cooperation with Internet companies, traditional home appliance companies that were originally "irreconcilable" began to put aside their past grudges and work together for warmth. On June 30, Hisense, TCL and Changhong came together and announced in the name of China Intelligence Alliance that they would unify the standards for payment, information security, advertising, games and investment and establish a unified entrance (the "Five-in-One" plan). This opened up the "group purchase" model for color TV merchants to cooperate with third parties. It is not an exaggeration to say that traditional TV manufacturers have entered a "cold winter". On the one hand, all home appliance subsidy policies have been withdrawn; on the other hand, Internet companies have entered the market strongly, and the color TV consumer industry will experience negative growth for the first time in 30 years. The color TV industry is in a "critical situation". But can Internet TV, led by LeTV and Xiaomi, replace traditional TV manufacturers? "I think it is absolutely impossible for Internet companies to replace traditional color TV giants in the future. We can only say that through their own efforts, they may have an impact on those companies that are relatively weaker. For example, AOC, Lenovo, Tsinghua Tongfang, etc. have all failed, and their market share is very small." Liang Zhenpeng believes. Liang Zhenpeng believes that the biggest problem of LeTV and Xiaomi is that they do not have the technical accumulation, talent advantages, their own factories, R&D resources, corresponding patents and reserves, sales channel networks and after-sales services in this field. LeTV's after-sales service in Shenzhen is outsourced to traditional companies, which shows that their accumulation in this field is very weak and even fragile. Just because LeTV and Xiaomi have come up with a new concept, it doesn’t mean it’s enough to subvert an industry. Moreover, this concept has not yet formed a truly successful business model, because the sales volume is too low and LeTV's TV is still in the investment period. Compared with traditional companies with annual sales of tens of billions, it is still insignificant. Moreover, facing the impact of the Internet, traditional TV manufacturers did not sit idly by, but actively responded. "LeTV can still occupy a place through its own efforts, but Xiaomi, which has neither technical accumulation nor content resources, will find it difficult to succeed," said Liang Zhenpeng. As a winner of Toutiao's Qingyun Plan and Baijiahao's Bai+ Plan, the 2019 Baidu Digital Author of the Year, the Baijiahao's Most Popular Author in the Technology Field, the 2019 Sogou Technology and Culture Author, and the 2021 Baijiahao Quarterly Influential Creator, he has won many awards, including the 2013 Sohu Best Industry Media Person, the 2015 China New Media Entrepreneurship Competition Beijing Third Place, the 2015 Guangmang Experience Award, the 2015 China New Media Entrepreneurship Competition Finals Third Place, and the 2018 Baidu Dynamic Annual Powerful Celebrity. |

<<: "Beauty Show Ecosystem" Who are the users of 9158

Recommend

The first flight was successful!

At 12:12 Beijing time on July 27, 2022, the Lijia...

Why do whales get stranded? What does stranded mean?

On the morning of April 19, a whale ran aground i...

6 channels for private domain traffic!

Many people don’t know how to generate private do...

The secret weapon of operational optimization: Re-understand the power of heat maps! (superior)

In this two-part article, I’ll describe how heatm...

This kind of food is recommended by the whole network in summer, but I advise you not to eat it

Summer is here, and it is a great season to eat r...

Hot search! Many people are looking for oyster sauce in the kitchen these days...

Oyster sauce is one of the indispensable seasonin...

What are the requirements for Baidu bidding creative writing?

For Baidu bidders, the most basic thing is to set...

Android advanced obfuscation and code protection technology

[[197795]] This is an article about Android code ...

Finally able to send large files, but still so stingy? Complain about WeChat's problems

WeChat has been updated, and this time it allows ...

In the competition of bean nutrition, which "idol" will stand out?

Soybeans, miscellaneous beans and various soy pro...

The Moon is "Rusting", and the Reason is the Earth?

On March 15, the National Space Administration an...

Reaching new heights: James Webb Space Telescope discovers record-breaking ancient galaxy

Recently, astronomers announced the discovery of ...

Did dinosaurs love to chew on dinosaur legs? What did Gorgosaurus eat for its "last supper"?

The study of Tyrannosaurus Rex and its relatives ...

Where is the real Three-Body World? Will it be the same as described in science fiction novels?

The TV series "The Three-Body Problem" ...

![Mumu Children's Photography Course [Good quality and material]](/upload/images/67cc2c80e7f71.webp)